The Differential | #3

David McCarthy

If you could price your best piece of content, would you price it as high as The Catalyst for Payment Reform does? / Boring, sense-making content makes a case for its place in marketing team’s priorities. / Transcarent’s earned media is boosting their digital visibility—when will they pass incumbents? / What if a book publisher advertised a MedPAC policy book? / And Lionel Richie shows up in a healthcare ad, because, of course.

B2B healthcare marketing, in the feed

Optum continues its regular presence in NEJM Catalyst, most recently publishing an editorial outlining a roadmap for the future of home and community care. Read the article

The Catalyst for Payment Reform launched a toolkit for referenced-based pricing. It costs $299. According to the landing page, the toolkit “contains evaluation questions and detailed specifications to meet the needs of employer-purchasers considering or reviewing reference-based pricing (RBP) solutions.” You know a brand is confident in its content when it charges the cost of a textbook. Kidding aside, I think this introduces a good question for marketing teams to consider when thinking through their next premium piece of content: What could your brand sell it for? Maybe a question like that can help determine which ideas are potentially most valuable to prospects. $ee the landing page

In the last Differential, I highlighted a “white paper” from Teladoc. This past week, they promoted a case study on their work with Friday Health Plans. The case study has the essentials: client profile, executive summary, testimonial, and impact. But what I wished to see was an exploration of Friday’s consideration set and their decision-making process—why did they choose not only Teladoc, but Teladoc’s category? In my perspective, with case study results almost always being exceptional, the decision-making section is where the seller can differentiate and enable the prospect to truly see themselves in the client’s shoes. Check out the case study

A recent Devoted Health ad stars Lionel Richie. No clay sculptures were featured, sadly. See the ad

Vera Whole Health may be keeping long-form content (and the careers of English and journalism majors) alive on its own. On LinkedIn, the brand is promoting its ebook The Definitive Guide to Evaluating On-Site Clinics, which I touch on later. Check out the ebook

BrightMD published a six-page listicle introduction to its asynchronous telehealth solution. Read the intro

Lyra launched an epic of a 4,500-word evergreen article titled “A New Approach to the Outdated EAP.” The article seemingly sets out to do two things: establish Lyra’s approach to EAP as the future of EAP and rank the heck out of “EAP.” With the latter aim, they’re being quite intentional, offering jump links to different sections whose subheads are packed with “EAP” and searches related to the topic. I’m not sure a brand can skyscrape existing articles on an established topic and establish a new strategic narrative (I don’t know the space well enough), but I applaud the effort and their investment in an evergreen page like this, which ties so closely to their business. Scroll the article

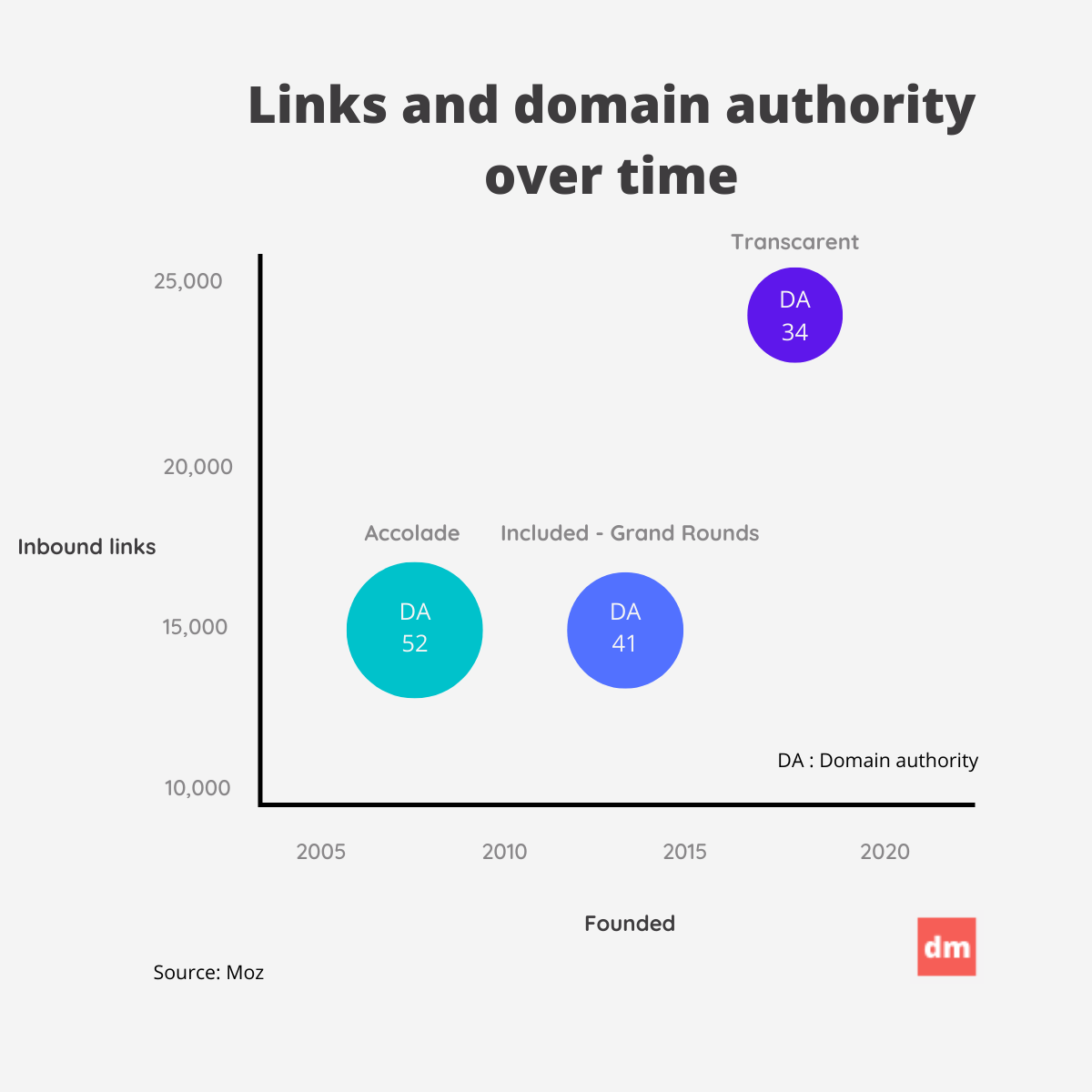

Homeward CEO, Jennifer Schneider, MD, MS, was interviewed on McKnight’s Home Care podcast, and she’s earned lots of media, it seems, over the past couple months. Before joining Homeward, Dr. Schneider was the chief medical officer and later the president of Livongo. I wonder if she and her team are following a PR and earned media playbook similar to Glenn Tullman’s. Listen to the podcast

And now, some data on healthcare content marketing

A differential diagnosis

The case for boring, sense-making content

TL;DR: Category buyer guides and brand starter guides still have a place in B2B marketing team’s content strategies. And they’re arguably more important than ever in B2B healthcare.

Buyer guides aren’t sexy content. Marketing leaders probably won’t feature them when presenting to senior leadership or the board, and they likely won’t find a place at the top of marketers’ portfolios.

I understand why. Generally, these guides don’t generate a reliable volume of leads, they can have high CPC, and they aren’t brand-awareness builders. They don’t, ostensibly, establish a narrative for your brand either.

But in B2B healthcare, they can have value in accelerating pipeline and perhaps bypassing or getting ahead of the RFP process.

Here’s why I think that: to buyers, the B2B healthcare marketplace has become a cortisol-triggering, endless catalogue of options. Buyers face a deluge of point solutions, aggregators, and other tools to choose from. And with those potential products comes an endless amount of feature sets, case studies, benchmarks and data points, and product collateral, which can be hard to sort through.

Unsurprisingly, Gartner reports that “buyers, overwhelmed by information, are struggling to make purchase decisions…55% of customers say that making informed trade-offs between vendors and their capabilities is difficult based on the information encountered during the buying process.”

Category buying and brand starter guides, coupled with a “sense-making approach” from growth teams, have the potential to distill the noise, make sense of the marketplace, and cultivate ever-important trust. Not bad accomplishments for some boring pieces of content.

Name that healthcare brand!

Which brand’s voice does the following title sound like most? (The answer is in the end notes at the bottom of the page.)

Health Care’s Tectonic Shift – What Payors Must Know to Succeed

Optum

Accolade

Teladoc

CareCentrix

All of the above, because everyone sounds the same

Napkin drafts of B2B healthcare marketing plays

Let’s atomize an ebook

In the last note I sent, I asked whether the “stand-up comic approach” to content deserved some consideration instead of the traditional “content atomization” approach, especially for leaner marketing teams, who may not have the luxury of campaigns that miss the mark.

In the former, a team tests out topics, messaging, and content bites in smaller “settings” before aggregating it into something longer or higher value, like an ebook or a course, which often requires more dollars to distribute.

In the latter, the process is, generally, reversed: the more-substantial content asset gets built first and then broken apart into smaller pieces.

Teams may be able to employ both strategies simultaneously. And if a team is confident in its audience insights and market understanding, atomization may still be the easiest approach—especially if your longer pieces of content are hyperfocused, well-organized, and educational.

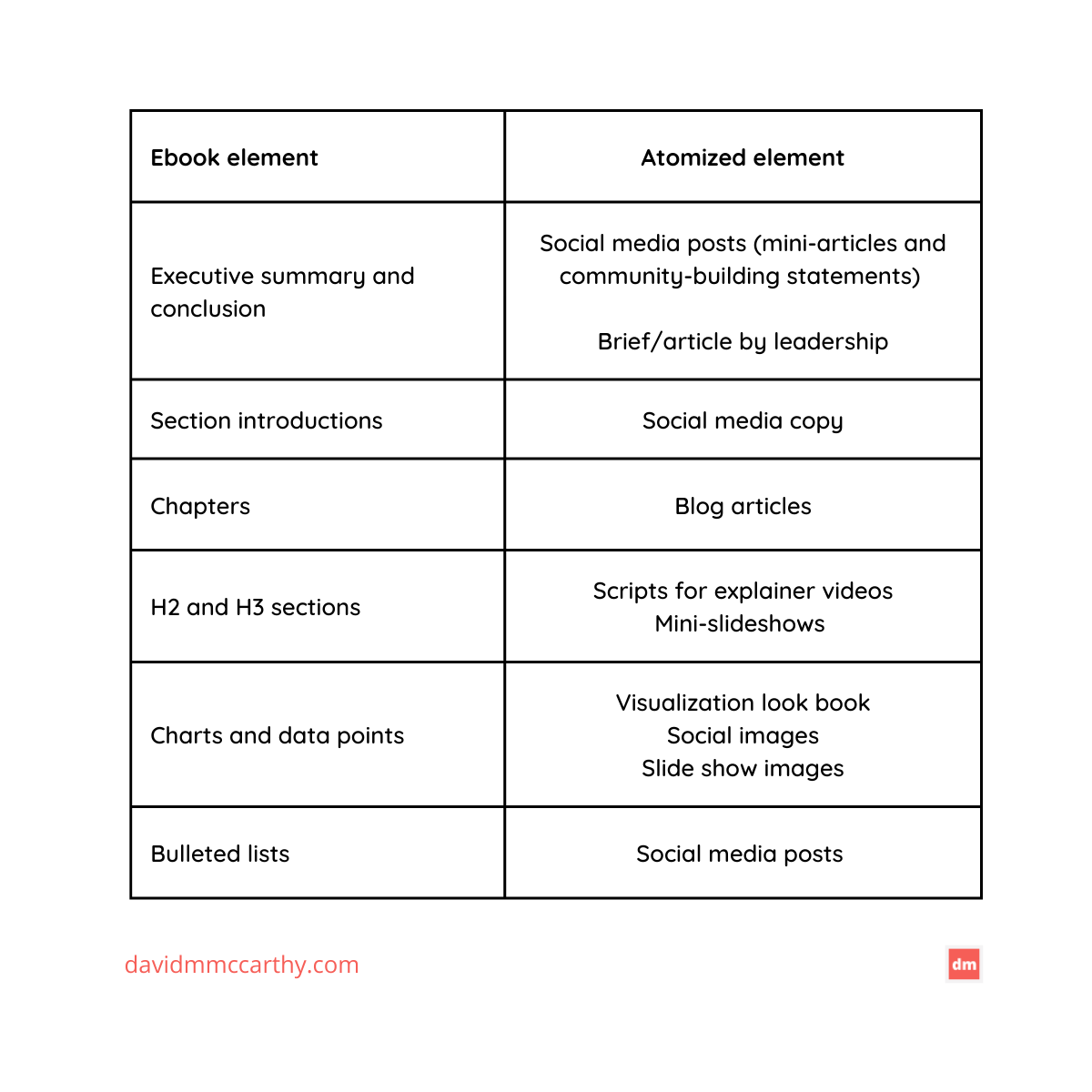

The ebook from Vera I note above is a great example of that. The asset is structured and consistent, which streamlines repurposing. And it’s focused on educating rather than selling, which improves the chances that atomized elements will see solid engagement.

Here’s a quick draft of how the ebook can get atomized.

If a consumer brand designed a B2B healthcare ad

I’m always curious why we healthcare marketing teams don’t promote long-form content more often like book publishers promote their biggest-bet books. To me, the desired actions for both seem the same—exchange something, like an email address or twenty dollars, to page through the work. So that got me thinking, what could an ad for a dry MedPAC PDF look like?

On marketing tactics

I’m just catching Social Insider’s study from the spring on the best type of content for LinkedIn. Read the study

I whole heartedly agree. ABM isn’t just retargeting prospects with display. Read the article

Gartner is reporting that in 2022, CMOs are allocating more than half of digital spend to paid channels. Almost 30% is going to paid search, digital display, and digital video advertising, a figure that really surprises me. Page through the study

Growth and experimentation agency CXL poses a curious question: which is more meaningful to a business: big-bet experiments or focused optimization? Andy Crestodina from Orbit Media Studios breaks the differences down between the two strategies, using a familiar trope: the tortoise and the hare. Read the article

Answer to “Name that brand!”

CareCentrix, Walgreen’s latest investment. (Also accepted—”All of the above.)

Sometimes I post on LinkedIn, too

A brief disclaimer

I reference and link to many healthcare brands in the newsletter. Including them does not signify an endorsement of their business.